The 4-Minute Rule for Home Equity Loan copyright

Table of ContentsWhat Does Home Equity Loan copyright Mean?Fascination About Home Equity Loan copyrightSome Known Questions About Home Equity Loan copyright.A Biased View of Home Equity Loan copyrightNot known Facts About Home Equity Loan copyright

A home equity financing can be a wonderful means to aid you reach your goals, yet at the end of the day, it's your home that's on the line. If you're over 55 years old and do not have a consistent revenue, a reverse home mortgage could work much better for you.

Jordann Brown is a freelance individual finance writer whose locations of experience include debt management, homeownership and budgeting. She is based in Halifax and has created for magazines including The World and Mail, Toronto Celebrity, and CBC. Prev 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 Following The material provided on is details to aid customers come to be monetarily literate.

Tax, investment and all other decisions must be made, as suitable, just with assistance from a certified expert. We make no representation or guarantee of any kind of kind, either express or suggested, relative to the data given, the timeliness thereof, the results to be acquired by the use thereof or any type of various other issue.

You take out a new home loan that pays off the old and after that provides you a payout of the difference. Making use of the example over: If the home is worth $250,000 after that 85% of that value would be $212,500. Minus the continuing to be $100,000 equilibrium on the home loan, you might fund up to $62,500 with a home equity lending.

About Home Equity Loan copyright

Closing prices normally vary from concerning 2 to 5 percent of the financing amount. The passion price on the equity car loan relies on your credit history. This indicates you should have a good credit rating to look for a home equity financing successfully. Home equity fundings are often frequently described as "second mortgages" because you successfully have actually 2 financings secured on one home.

A HELOC is normally an adjustable-rate financing that has interest-only settlements for a duration of time. After 10 years, the settlements balloon due to the fact that you must pay back the principal, as well as the interest.

This can make it simpler to take care of the financial debt. Think about all your alternatives thoroughly before you decide which financing option is right for you. Making the selection to access your home's equity is not a choice you can ignore. The equity is yours to utilize, but bear in mind that adding added financing to your home boosts your danger.

What Does Home Equity Loan copyright Mean?

This means you must just utilize this sort of funding choice if you have a clear, strategically viable reason to do so. You must likewise identify if taking out the finance or HELOC will certainly boost your danger, and by exactly how much. Home remodellings and remodeling are among the most common uses for this kind of funding.

It might appear strange, but you can utilize home equity loans to strategically spend your money. If the price of return is more than the interest price on the finance, after that it can be a smart choice. This only jobs when mortgage prices are low and the financial investment market is strong.

The Only Guide for Home Equity Loan copyright

You can also utilize the equity to pay off your trainee finances. If you have a major cost that comes up that you can not cover with cost savings, you can make use of a home equity lending or HELOC to supply the money you need.

Bank card have significantly high rates of interest most cards have prices in the high teens or twenties. By comparison, a home equity funding or HELOC would typically have a much lower rate. The trouble is that you take out a safe loan to pay off unprotected financial debt. This dramatically enhances your danger.

It permits elders to gain access to home equity without adding threat of loan default seen with standard home equity lendings. Both options permit you to accessibility equity, however there is less danger with a reverse home loan.

The Buzz on Home Equity Loan copyright

We contrast these 2 lending items to help you comprehend why you ought to make use of one and not the other when you want to eliminate credit rating card debt. Learn exactly how to safeguard your home while accessing equity.

Edward Furlong Then & Now!

Edward Furlong Then & Now! Bug Hall Then & Now!

Bug Hall Then & Now! Danny Pintauro Then & Now!

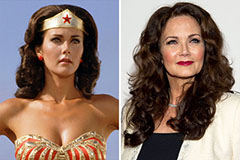

Danny Pintauro Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Mary Beth McDonough Then & Now!

Mary Beth McDonough Then & Now!